As a follow up to this macro-stock-market review on the best day of the week to trade, I dove into the best time of the day to trade. I learned that the stock market is driven by two fears.

Table of Contents

Hypothesis

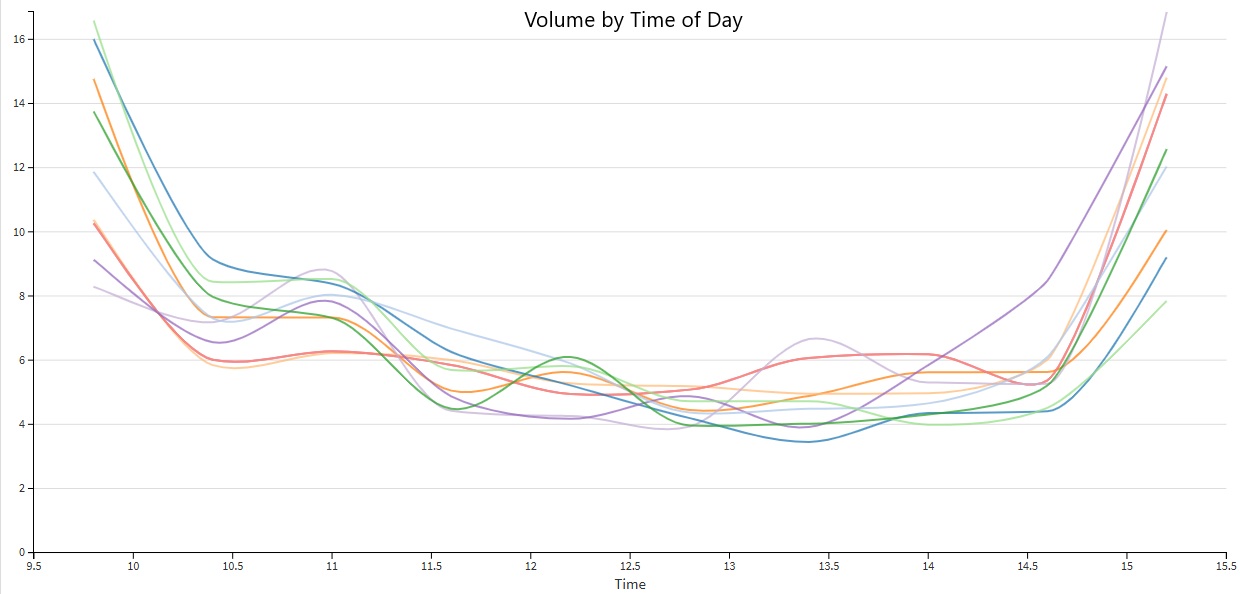

I believe the market open will trigger a volume spike across tickers, and the close will lead to a slightly smaller spike. There will be random fluctuations throughout the day. Furthermore, net volumes will follow the same trend as I’d assume volume to be positive in the long run.

Discovery

Across the 10 stocks that I reviewed, the trend was clear. There is a large spike at the open and close of the market as expected. I was incorrect, however in the assumption that the morning spike would be larger than the afternoon spike. This can be demonstrated better in this bar view:

We can see that many securities do in fact have a larger open volume than close volume, but that is not consistent across the board.

The next thing to review was the net volumes:

While many did open with positive volumes, they generally were not significant. Additionally, the days’ close left little to conclude. The main takeaway here is that time of day is not a great indicator of positive vs negative volume flows.

Analysis

There are some surface level takeaways here worth calling out, but there is also a greater message in the data… I’ll save the best for last.

Starting with the surface-level review: Net volumes are unpredictable solely from the time of day. That is not the case for total volumes. This review has shown that there is a strong correlation between the time of day and the total volumes. You can expect high volumes and increased volatility at market open, followed by a lull, then another high volume period nearing the days’ close.

The Stock Market has 2 Fears

What is more interesting here is the psychology buried in the data. I believe that very first chart shows that the stock market is driven by two fears:

- Fear of loss

- Fear of lost opportunity (FOMO/Greed)

Entering the trading day, volumes are likely high due to thoughts from the previous day/night: “I should have invested yesterday” “I should invest tomorrow” “This is an amazing value and I need to get it first” “I heard some news/rumors and need to get out before this crashes” – These are all thoughts that occur when the market is closed. People fear they are going to lose or miss out on money.

A Telling Close – Irrational Action

The concept of market open spikes makes sense. Much can happen while the market is closed. From news and earnings, to political moves, a period where folks cannot trade causes anxiety about the lack of access. What may be more interesting is the second spike. This spike paints a much more significant picture in my eyes. Nearing the end of the day, there is less likely for significant news to have been broken, simply due to the amount of time the market is opened vs closed. There is generally no difference between a company’s position 3 hours before the market closes, and 3 minutes before it closes. Despite that, there is a major variation in volume. This is where the significance of the stock market fears comes in.

Without great reason, buys and sells come rushing in before the market closes. “I need to get in before it goes up, I can’t miss out” “I need to get out before this crashes, I can’t lose this” – These statements are very similar to the premarket statements, but now they come without reason. There is likely no news not known at the start of the market session that is driving the decision, meaning the price has had time to adjust. Instead, folks are making emotion based decisions, causing significant volume and leaving room for wise investors to profit. In fact, pre-close price movement may be one of the best indicators of a security’s sentiment… Maybe I’ll dive into that next?